Welcome To Pifer's!

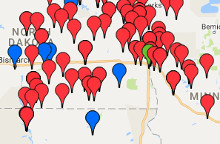

Pifer's Auction & Realty is a full service auction and real estate firm specializing in land auctions, machinery auctions, and land management. Pifer's has several offices in North Dakota, South Dakota, Montana, Minnesota, Wisconsin, and Arizona to serve you. Contact a Pifer's Associate today for a FREE Consultation - 877.700.4099 or info@pifers.com

Toll Free: 1-877-700-4099

Toll Free: 1-877-700-4099